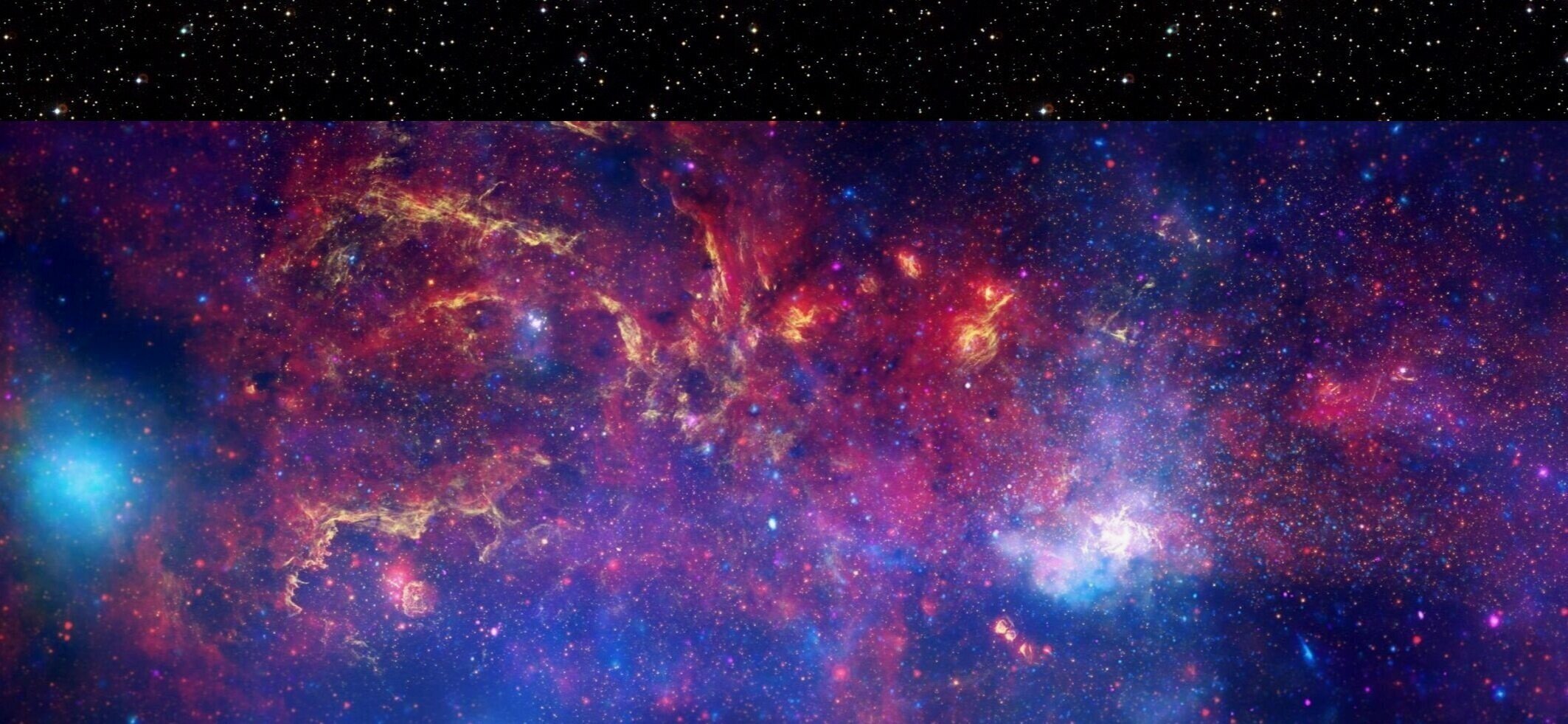

The Universe is out there, waiting for you to discover it.

There’s a cosmic story uniting us.

We’re determined to bring it to everyone.

Our Creations

On Big Think, Medium, and Patreon

From before the Big Bang to our ultimate cosmic fate

Exploring the Universe on SoundCloud, iTunes, and more

Get early access, exclusive content, and bonus rewards

The Universe tells a story

we all deserve to hear

Want to know what this Universe is, how it was born, how it grew to be this way, and what its ultimate fate is?

So do we. Let’s take that journey together.

Learn more about our mission, history, and goals.

Contact

The Universe is yours to explore.

We’re here to bring it to you.